On January 31st, we published a blog focusing investors’ attention on bonds. Since then, the main equity index, the SP500, lost 6.5% while the Aggregate Bond Index gained 2% and the 10-year US Treasuries gained approximately the same amount (as measured by TLH, the tracking ETF).

We are revisiting the topic of bonds not as a victory lap but as a way to introduce a new element. The policy choices made since the beginning of the year have resulted, among other dislocations, in a weakening of the dollar. The combination of an historically high valuation of the greenback, money flows reversing with global investors repatriating significant portions of their funds (especially European investors), and a declared intent to use dollar weakness as an additional tool to rebalance the trade deficit have combusted this move downward.

At this point, we should ask the question if there are probable causes to expect the downward move to continue. Talks about the displacement of the dollar as the global reserve currency have recurrently surfaced in economic circles but the reality is that even now as the known world order is being rearranged, there are no likely substitutes. The Euro is still fragmented as every country issues its own debt with different yields, and the Yuan is not freely convertible.

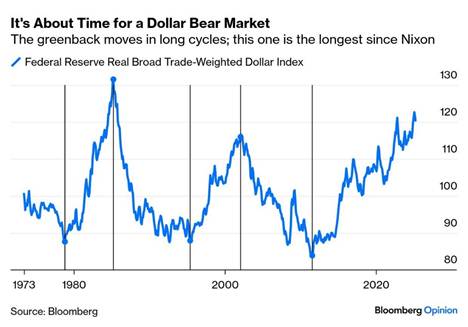

However, it is entirely possible to envision a long downcycle as these new geopolitical forces assert themselves. Historically, the greenback does move in long cycles which reflect major changes in global economic stances. The following chart (courtesy of Bloomberg) shows the cyclical tendency of the dollar:

So, what does this have to do with bonds? While the call for a strong bond focus remains, it may be a wise move to incorporate unhedged global bonds to the mix as a way to capture a global currency realignment.