As Tolstoy wrote in the opening of its masterpiece “Anna Karenina,” all happy families are alike, and each unhappy family is unhappy in its own way.

We can apply that principle to financial markets and crises as well. Every bull market is essentially the same, while every crisis is unique in its own development. Wars are especially tricky to analyze. First, because they affect us emotionally even when they are far away and furthermore, from a financial standpoint, they are always different in their strategic core and potential ramifications.

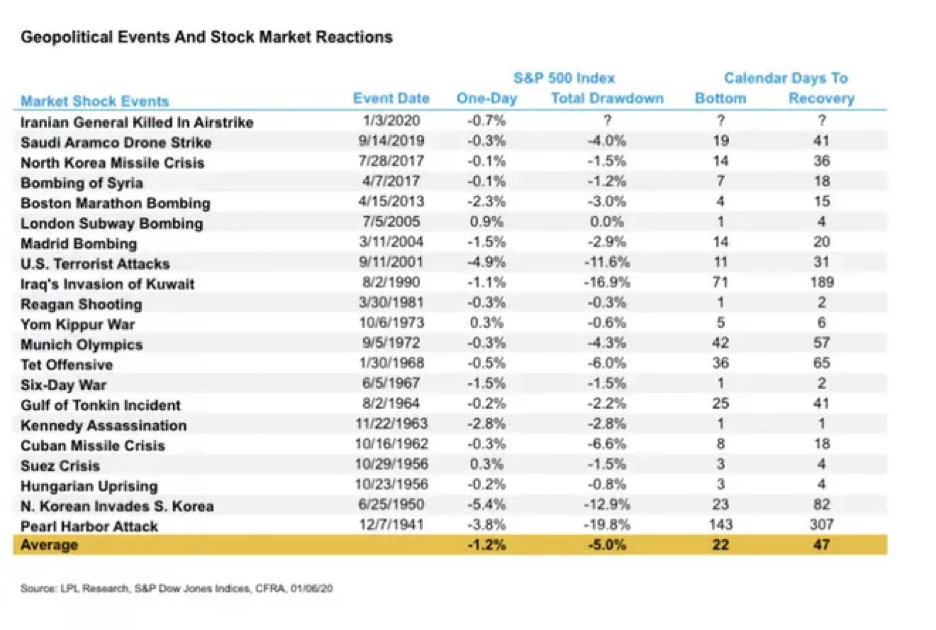

“Garden variety” wars tend to have short lasting effects on markets. The following table by LPL Financial shows the behavior of the S&P 500 during a number of wars, terrorist attacks and related crises since 1941.

And of course, the effect on markets also largely depends on which financial system relative to the epicenter of the crisis. For instance, currently, Russian stocks are down approximately 90%, give and take a few exceptions, while the US is practically unchanged. However, the current Ukrainian crisis possibly has longer and larger ramifications. To start, it occurs at a time of rapidly increasing inflation which hampers the ability of the Fed to provide supporting liquidity. The nature of the Russian economy, largely driven by energy exports, also fans the flames of more inflation by creating a supply shock as the ones last witnessed in the 1970s. What is more troubling from a long-term perspective, is the renewed specter of Cold War 2.0 with its consequences on global growth and redirection of some public funds to defense rather than more constructive uses. Certainly, opportunities will also arise as Western Europe will have to face the urgency of energy independence and most countries in general will need to retool their supply chains to mitigate global shocks. Renewables, nuclear power and robotics might be identified as possible long-term winners. Strategically, we may also see the beginning of a move away from accumulation of foreign currency reserves in emerging markets. The ability of the current system based on SWIFT to render Russian reserves essentially useless may push governments to find alternatives for their “rainy days” funds.

In the short term, however, uncertainty and volatility (up and down) will mark our trading days. In a context marked by inflation and heightened volatility, perhaps it is the time to visit an old friend: gold.