In our year-end missive, we spent a few words on the valuation discount of Emerging Markets versus the US. We focused our commentary mostly on the equity side, but we are currently witnessing interesting value anomalies in the sovereign debt space as well.

Ultimately, the actions of the Federal Reserve will continue to greatly impact Emerging Market policies and currencies and therefore a good read on Jay Powell’s mind is still required homework, however, a few positive elements are emerging (no pun intended…).

The last twelve months were certainly unkind to bonds in general as the Fed initiated the most aggressive interest rate tightening cycle in over 40 years. Despite generally solid fiscal positions, Emerging Market debt could not escape the reverberations. Even the perceived overvaluation of the US Dollar at the beginning of 2022 could not correct until late in the year as the result of Powell’s actions. A strong US Dollar was an additional significant headwind for local currency EM bonds. This situation translated into one of the greatest corrections in Emerging Market Debt history. Based on a report by John Authers at Bloomberg, EM debt’s correction last year was on par with corrections historically linked to major debt crises and yet last year, no debt crisis occurred. In fact, last year’s repricing was the most severe since the 1998 Russian default fiasco and was also comparable to what happened during the financial crisis of 2008.

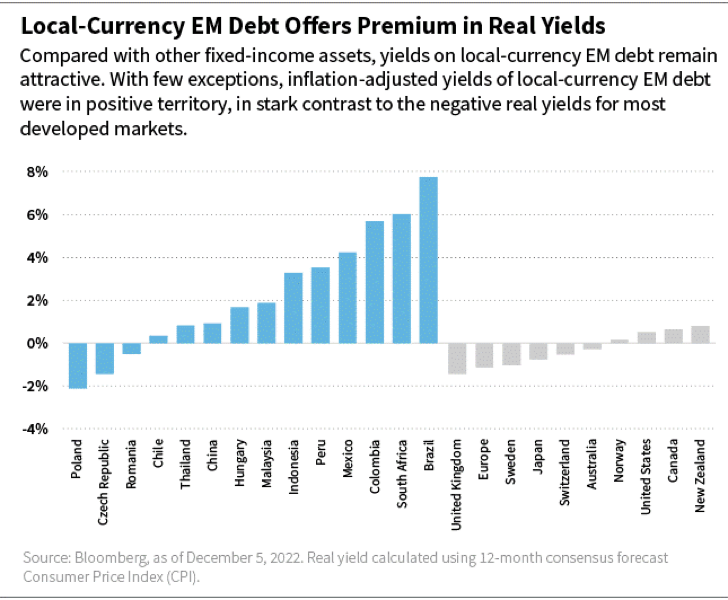

If history is any guide, those selloffs were solid entry points for intermediate term long positions in EM debt. Yields are now attractive not only from a nominal standpoint but even more so from a real perspective (a real yield is the nominal yield minus the local rate of inflation). And the US Dollar rally might just have finally run out of gas…