At THALASSA CAPITAL we have been biased over high dividend yield stock for quite sometime. Many of them make it into our ValueX strategy, many screen in our options program and of course our midstream exposure has been predicated, among other value reasons, on the high distributions paid.

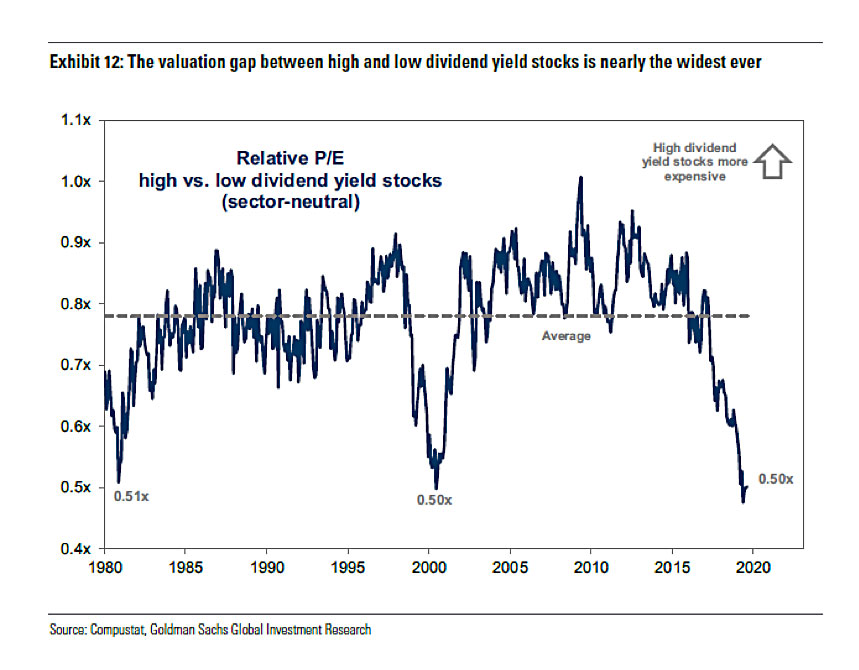

Recently Goldman Sachs pupblished an interesting chart (see below) which highlights the historical valuation gap between high dividend yield stocks and low dividend yields names. The recent relative P/E is near a 40 year low. Perhaps some of the distortion comes from the inceasingly popular buy-back strategy as a way to return cash to the investors; however, the extreme valuation gap does seem to indicate a fundamental relative discrepancy.

Goldman reports that the swap market implies a significant reduction of dividend growth from 8% in 2019 to 1% in 2020. This slowdown seems too drastic especially in light of Goldman’s long term view of dividend growth estimated to be of 3.5% until 2028.