Exchange Traded Funds (ETF) are the new building blocks of efficient portfolio construction. The great variety of asset exposures they provide, combined with low expense ratios, make ETFs a great tool for the modern portfolio manager in his/her quest for implementing either passive or active investment strategies. Good liquidity in most ETFs also helps reduce Market Impact Cost during strategy implementation and rebalancing. Additionally, available options contracts help manage risk when required.

Our ETF portfolios provide a cost efficient way to gain a diversified exposure to traditional asset classes. Our portfolios are actively managed in accordance with our investing philosophy and offer:

- sector diversification

- macro asset allocation

- implementation of proprietary market timing model

- foreign exchange hedging

ETF Sector Rotation Models

Why Sector Rotation

An economic system is a complex organism that is constantly affected by a multitude of dynamics; such a system is therefore always changing and each part of the total is influenced differently by the same impulses.

A responsive portfolio aiming to capture this synthesis would have to identify the rhythm of the cycle and the ramifications of this process on the different segments of the economy. Sector rotation strategies have been built over the years with the intention of capitalizing on this very process of change where different parts of the economy tend to benefit differently from cyclical macro inputs. The goal of course is to anticipate where the economy is headed and which sector will benefit more or less.

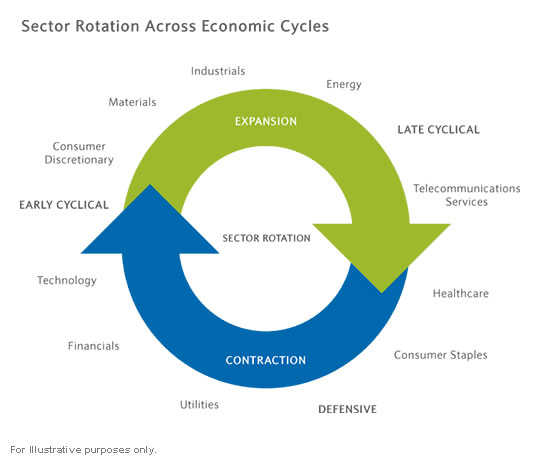

The classic economic cycle is categorized by 2 major phases:

- Expansion, divided into Early Cyclical and Late Cyclical

- Contraction, divided into Defensive or Early Recessionary and Late Recessionary

Sector rotation across economic cycles (source: Ishares.com)

In the above diagram (source: Ishares.com) we can see the industries that are set to outperform in each phase. Investors can utilize different approaches in their attempt to capture sector outperformances. The two more popular approaches are fundamentally driven – as in the ability to forecast with some accuracy where the economy is headed – or momentum driven – as in modeling quantitative strategies based on price persistence.

Why Momentum

Our firm decided to focus its research efforts on the momentum approach. Such decision was supported by a vast amount of literature and back-testing which showed how a “momentum anomaly” had been present in financial markets for decades across the globe.

Momentum can be structured with many different parameters but essentially is the tendency of stock returns to trend in the same direction. In a highly efficient market such anomaly should not persist for a long time as rational investors would quickly arbitrage the advantage; however, at THALASSA CAPITAL we believe that markets, while often efficient, do suffer from structural and behavioral imbalances that may limit arbitrage. Academics Fama and French already institutionalized the size and value anomalies (or the long term outperformance of small caps and value stocks) and in 1993 described momentum as the “premier anomaly.”

The reasons for such a simple edge to persist may vary from the behavioral to the technical; researchers such as Barberis, Stein and Hirshleifer, to name just a few, have attempted to model behavioral theories rooted in investor cognitive biases. Most explanations revolve around the ideas of under-reaction to news, speed of news spreading, institutional ability to reach size, irrational price confirmation needs and so on.

Many studies identified single stock outperformance in momentum models built with intermediate timeframes, defined as 3 to 12 months ranking and holding periods. Dimson, Marsh and Staunton (2008) produced the seminal work “108 Years of Momentum Profits” where they tested different parameters in UK stocks from 1900 to 2008 and in 17 other countries for some 33 years. Their comprehensive study confirmed previous findings identifying alpha in the 12 month and 6 month horizons.

One striking element in this body of evidence is the concentration of selected individual stocks in same industries each time. Research would seem to prove that the industry effect is a powerful element of price formation in the selection process. Moskowitz and Grinblatt (1999) validated this idea in their work “Do Industries Explain Momentum?” where they found evidence of industry portfolios exhibiting significant momentum even after controlling for size, book to market equity, individual stock momentum, cross sectional dispersion in mean returns and potential microstructure influences.

Moskowitz and Grinblatt also found that the profitability of industry strategies over intermediate horizons was predominantly driven by long positions.

Methodology

As explained, our model finds solid foundations in the studies performed over the years by different academics, analysts and money managers. The presence of Alpha in momentum investing transpires under different parameters ensuring a concrete rationale for its very existence.

In our approach, we took into consideration expected profitability but also slippage and efficiency of execution. Momentum parameters are usually divided in 3 sections: the ranking, lagging and holding periods. Alpha resides in the intermediate horizon as far as ranking past performance and for this reason we chose an interval that should be sensitive enough to changes in the economic cycle. Most studies tested performance by including a lagging period of usually one month; this lag is designed to offset the tendency of stocks to short term mean reversion. We decided to skip the lagging period on the account that it seemed to add little value in an industry driven model. As far as holding period, the trade-off is between higher expected performance and slippage. Usually the faster the rebalancing the higher the returns but also the higher the slippage and the commission costs. In building our model, we aimed to strike an acceptable balance.

In order to address efficiency of execution we decided to implement sector exchange traded funds. The variety of ETFs available, the rising liquidity in these instruments and their low expense ratios (and in most cases tax efficiency) made it very attractive to build a model centered on a sample size of 40 exchange traded funds. The attractiveness of sector rotation investing via ETFs was tested by Prof. Accomazzo in two articles: “Active Alpha Investing for the New Normal” (Active Trader Magazine, 2011) and “An Alternative Way to Manage Equity Portfolios” (Graziadio Business Review, Pepperdine University, 2009).

An additional risk management overlay via options may be added on a discretionary basis depending on market conditions.

Please request a meeting for a more tailored discussion on an ETF portfolio which is appropriate for your investing needs.