Slowly but surely, each day we inch a little closer to the 2020 Presidential Election, a classic volatility event for all financial markets. The consensus among market participants is for a sweeping Blue Wave that would probably translate in a couple of years of simultaneously loose fiscal and monetary policy. In this future context, portfolios should skew toward highly cyclical sectors and probaby scale down on overpriced large tech. In a victorious Blue Wave, tech might also find itself as the object of more regulatory scrutiny which may, as it did in the 1990s with the Microsoft anti-trust proceedings, put a damper on expanding valuations.

The problem with this scenario is that while polls in favor of the Biden ticket have been quite consistent in indicating a significant margin of preferences, some battlegorund states are still way too close to call and a few races in the Senate are also still too close to call. From a fiscal perspective, we could say that races in the Senate are indeed more important than the Presidential outcome. The next two weeks could see major shiftings and of course we all still remember how wrong polls have been in the last two major political events of the last few years (Brexit and US 2016 election). From a market perspective, it’s not much about who the winner eventually is but the possibility of a long and contested post-election period.

As it is always the case in these contingencies, a diversified, long term portfolio in sync with an investors’s goals and risk profile is the necessary foundation. For those investors that may be more tactically inclined rasing cash or buying hedges are another line of defense. They both come at a cost in case the worst case scenario does not come to pass but so it’s your “car insurance premium………”

Regardless of a Blue Wave sweep, we should continue to see sector rotation from Growth to Value. The switch is emerging timidly and given valuations differentials and technicals, it should continue to evolve but it would certainly benefit from more aggressive post-election fiscal policy.

On the Credit side, we also see a continuation of the present environment, regardless of election outcomes, as the support of the Fed for corporate credit should continue unabated for a long time.

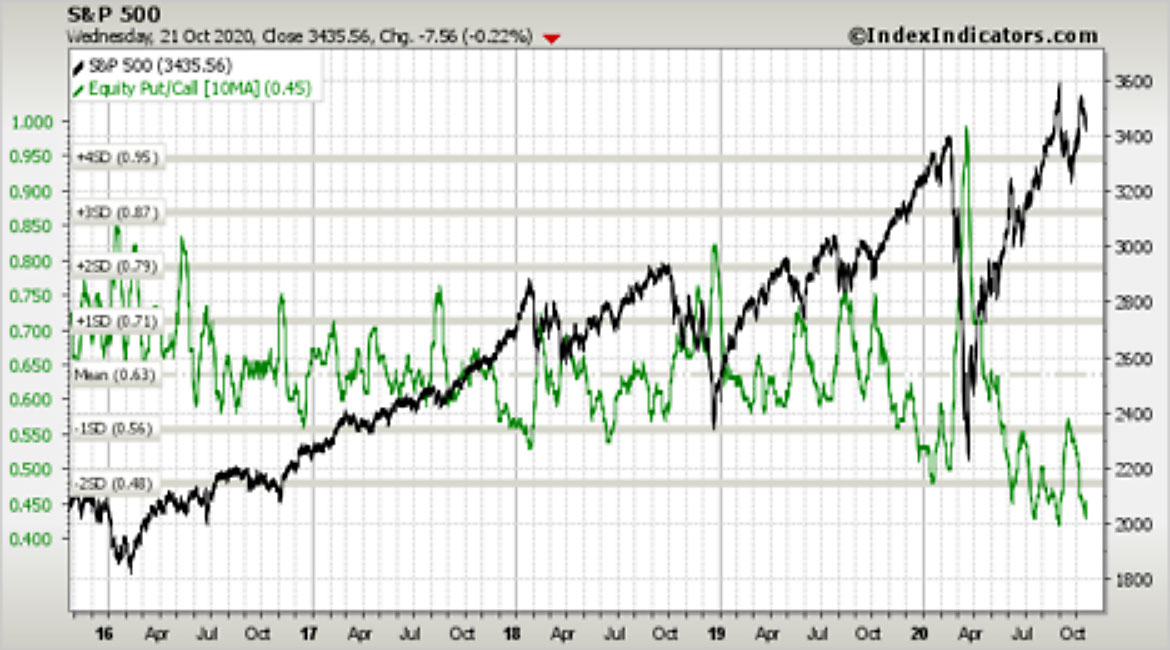

In conclusion, we offer a chart (courtesy of www.indexindicators.com) showing one of our preferred market-wide risk metrics: the equity put call ratio. The persistently low level of this sentiment indicator underlies the somewhat complacent positioning of market participants. From a contrarian perspective, this indicator flashes red for domestic equity markets.