Volatile markets are an inherent part of the financial fabric and stress that relationship between risk and return that is the trademark of investing. The higher the expected rate of return of an asset, the higher the volatility of such returns. This relationship explains why equities over time produce higher returns than “calmer” assets such as bonds.

Unfortunately, once in a while, heightened volatility hits all markets simultaneously and systemic instability ensues for some time such as in 2008 and more recently since March.

In times such as these, investors must remind themselves of the basic dynamics in the investment process.

- Market Volatility: volatile moves alter the risk profile in the current market conditions and may induce opportunities to rebalance existing allocations.

- Go to the Sidelines: Good or Bad? A sound asset allocation should be able to withstand significant temporary shocks and require only minor changes. Radical risk repositioning and market timing often produces inferior results. On average, in the 12 months following the end of a bear market, a fully invested equity portfolio has returned 37.1% (source: Ned Davis Research Group). An investor that moved to the sidelines and missed the first 6 months of the recovery would have made only 7.6%

- Dollar-Cost Averaging: averaging your way into your ultimate allocation is a superior way to deploy funds during times of high volatility. Technically, one should buy into the markets as a function of price, taking advantage of volatility, and time in order to mitigate market timing miscalculations. Such an approach also reduces anxiety which often increases the probability of an execution error.

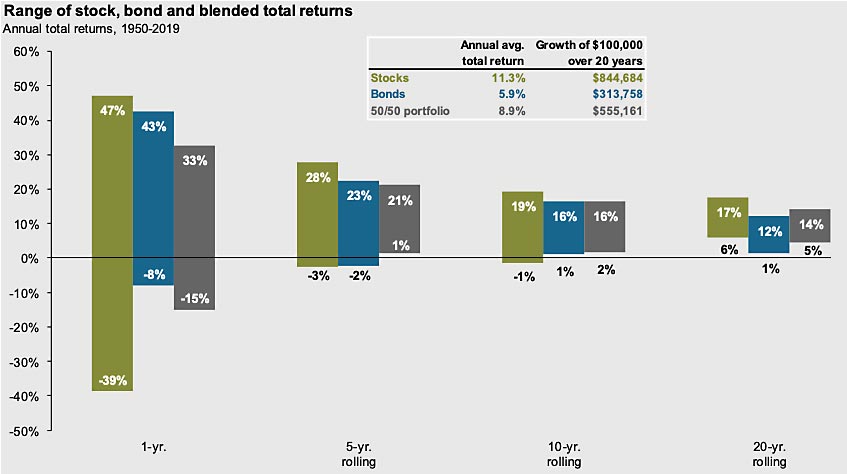

- The Long-Term Perspective: most volatility is really just short-term noise and only a small portion is truly a reflection of structural changes. One should tune out noise and focus on fundamental drivers of long-term economic growth. Market investors should also take the approach of buying stocks as if they were buying real business; this dynamic will force a Main Street analytical framework as opposed to a Wall Street “trading” mentality. While over any one-year period, the variability of equity returns can be above 40% up or down, over longer periods, the range compresses massively. The chart below, courtesy of JP Morgan, clearly illustrates this fact. Since 1950, a rolling ten year holding period of an equity portfolio has seen its range reduced to between negative 1% to positive 19%.

Next Steps

Once reminded of these four basic elements of investing, one should take the following steps:

- Review his/her financial plan

- Review the asset allocation

- Identify long term opportunities

- Act on the plan

- Stay calm and carry on

For the history buffs, we may also suggest reading up on the fascinating history of the Bull and Bear markets of the last 100 years. The Roaring 1920s carried unbounded optimism for a young country that was itching to burst onto the world economic stage. Such euphoria and excesses, combined with erroneous monetary policies, lead to the Great Depression. The economic devastation of the depression was enhanced by the toxic policies that rose to dominate the global landscape, eventually engulfing the whole world into the flames of war. From the ashes of such abomination, the reconstruction started leading an unprecedented wave of rising global wealth. The bull market continued into the 1960s helping shape not only economic changes but also positive social changes. Stagflation followed in the 1970s, when eventually stern monetary policy and improved fiscal decisions set the foundations for the great Bull of the 1980s and 1990s. In the year 2000, we entered the world of volatility followed by the great run of 2009 to 2019. We can now label 2020 as the year of the Virus; can we bet on 2021 as the year of the Recovery?