So far this year, the biotech sector has been on a road to nowhere. This is not too surprising as the sector is digesting the positive run of 2017 and it is coping with a general market background marked by higher volatility.

In addition to the above-mentioned macro elements, the sector has showed some specific issues that have temporarily cooled off investors’ enthusiasm. For instance, treatments pricing issues continue to create uncertainty and make long term cash-flow projections harder to model. We also witnessed a few setbacks in clinical trials that, while highly typical in the biotech process, have caused short term disappointment. And lastly, M&A activity has been year to date less thunderous than expected at the beginning of 2018. Earning results from the first Quarter reflected much of that uninspiring background and were largely uneventful.

Nevertheless, the intermediate and longer-term reasons to own the sector remain utterly unchanged. New product launches are in the pipeline and they should provide reason for fundamental optimism. A surge in new products may also help accelerate the M&A wave we have all been expecting. Innovation is indeed taking place in the space and the dynamic of large cap names needing to replenish their portfolios by assimilating smaller R&D driven entities is still very much a reality of the biotech universe.

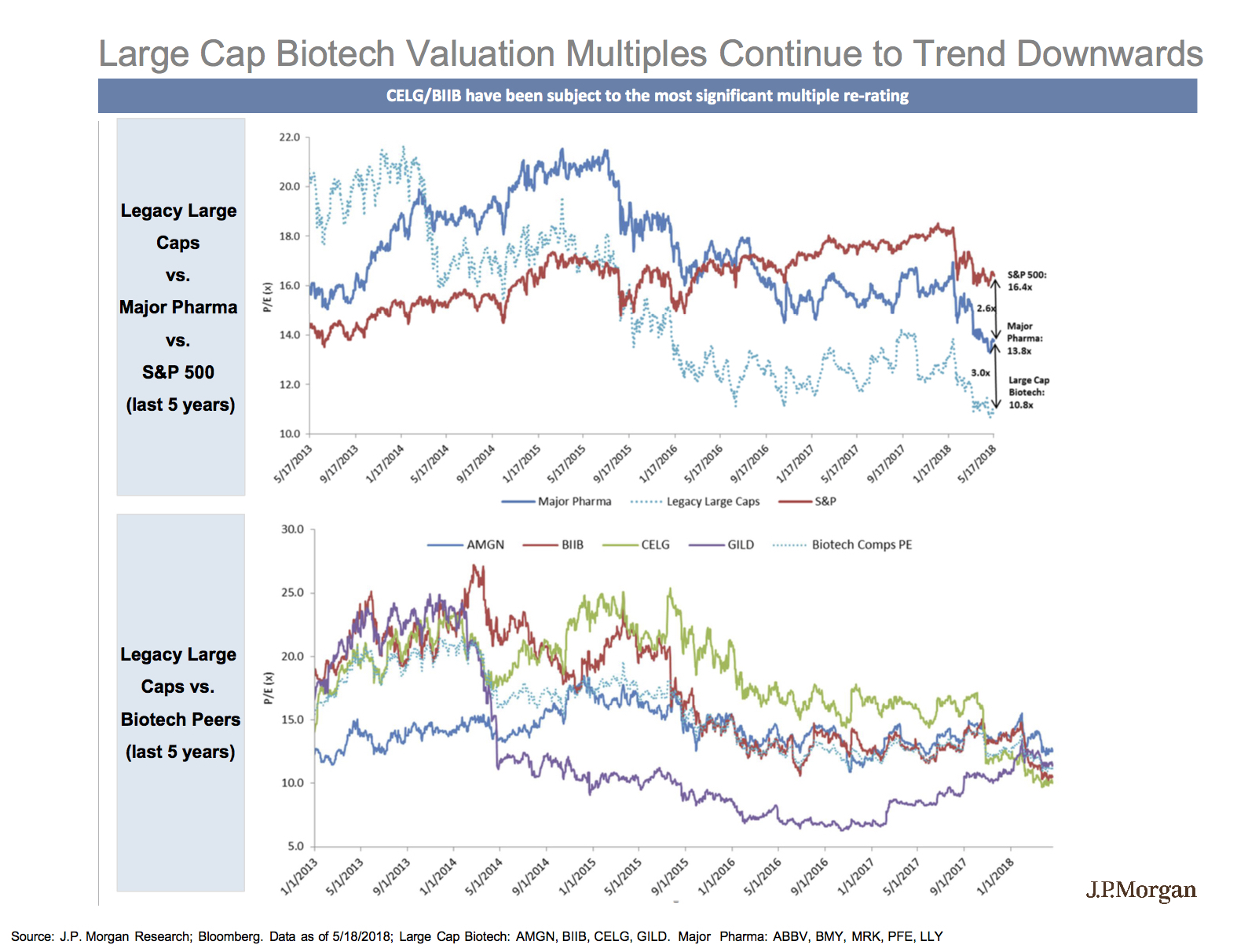

The following two charts (courtesy of JP Morgan) illustrate the pivotal events that have marked the sectors year to date and the decrease in the sector’s valuation multiples since the peak three years ago.

JP Morgan research not only shows the sector relative value compared to the S&P 500 but also stresses how the large cap biotech sector is trading at a valuation advantage relative to the US major pharma names. This is occurring in spite of the fact that both groups share very similar growth expectations. This kind of disconnect between valuations and projected fundamentals could be eventually resolved into a major arbitrage move by the sector.

From an historical perspective, large cap biotechs have returned approximately 15% per year over the last 10 years and small cap biotechs have produced annualized returns of over 17% during the same period. Conversely, the benchmark S&P 500 has produced annualized returns of just over 9%. Naturally, such outperformance has come with a price: volatility. While the 10-year standard deviation of the S&P 500 revolves around 15%, large cap biotechs (IBB) show standard deviation of over 21% and the small cap sector 28%.

The key points that transpired from the first Quarter earnings reports in regards to some of the most prominent names were as follows:

- Amgen beat expectations albeit only by a minimal amount. The company is well positioned in terms of new products with good candidates in the early and mid-stage. Amgen remains undervalued when evaluated by traditional DCF measures.

- Biogen reported results in line with expectations. Gross revenues are growing and ROE, even though reduced over the last 12 months, remains very attractive. Biogen also seems highly undervalued.

- Celgene reported good numbers and decent future guidelines. This was a relief and possibly a turning point in a company that over the last six months has stumbled more than once in its way to consolidate its position as a major. Celgene’s dominant position in the multiple myeloma space remains unchallenged.

- Gilead unfortunately missed on top and bottom lines yet it remains undervalued and very much a turn-around story.

- Biomarin has confirmed a diversified foundation and a growing commercial portfolio. JP Morgan ranks it as one of their highest conviction long-term ideas. Biomarin could soon enjoy tailwinds in the gene therapy sector where a number of their products are emerging. Biomarin is currently rated undervalued by Morningstar and JP Morgan.

- Vertex reported higher than expected numbers on top and bottom lines and stressed good potential for their portfolio beyond their cystic fibrosis product.

Amgen, Biogen, Gilead and Celgene (along with a few other such as Regeneron, and Merck) are also names on the forefront of the new process of combining traditional bio-research with Big Data. New data and analytical tools can help make the process of discovery for new treatments much more efficient and faster. The average cost of development for a new drug is around $2 billion with yearly cost increases of approximately 10%; any procedure that can help reduce such expenses and accelerate the R&D cycle can provide a massive advantage.

In terms of future developments in valuations, much rests on the two key themes we mentioned earlier in our analysis: pricing issues and M&A activity. On the pricing theme, recent commentary out of the White House has been less damaging than expected; however, some degree of skepticism is in order given the erratic style of this Administration. Given this premise, it is unlikely that a major reform of pricing policy will be implemented in the medium term.

On the M&A side, YTD we had seven deals announced which in size and absolute number are already above the yearly average of the last ten years. The premium paid to the average 30 day price of the target companies has been as high as any time in the past ten years (source: JP Morgan). This pace can continue, and hopefully accelerate, as large caps do have cash to spend (approximately $76 billion) and the ability to leverage the balance sheet. This element in unison with depressed valuations and the recurring need of large caps to improve their portfolios should guarantee an extension of the M&A story. The urgency to execute deals was stressed by many executives at the helm of large biotechs. Executives at Amgen, Biogen, Celgene and Gilead have all confirmed their intention and their ability to execute strategic deals.

At THALASSA CAPITAL we are working on creating a seminar focused on the biotech space and on our sector focused portfolio; should you be interested in attending please contact our team at 310-867-2255 or by email